Who We Are

Our Vision

Empower parents to raise a financially confident generation

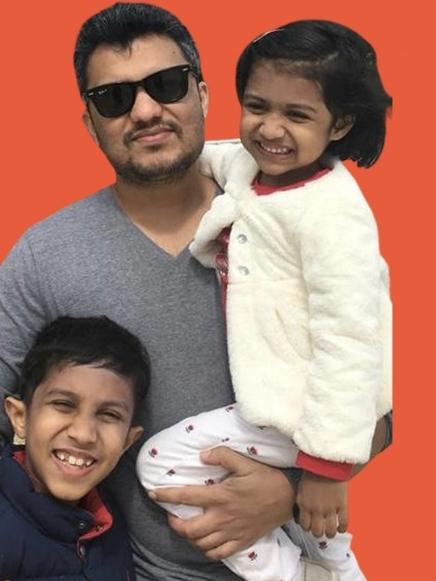

Gaurav Patodia

Co-founder

My inspiration for starting Milestone was my children. I spent 17 years in banking, and was surprised at the lack of financial literacy amongst adults.

Complicated financial products, a growing digital economy, explosion in social marketing and adverse incentives only added to the problem. I was worried that the next generation, including my children, had no tools that expose or educate them about good money habits at an early age; an age that research has shown to have a strong bearing on our future behaviour.

Hence, what started with teaching money-management and budgeting to my son over spreadsheets, slowly turned into an initiative to help other parents do the same.

Ankita Singh

Co-founder

The idea of Milestone really appealed to me because when I look back at my own experience with money, I realise that a lot of my spending, saving and investing habits are based on what I observed my parents do.

The seeds of financial discipline are planted at a very early age. I also noticed that when it came to learning about money, there weren’t any specific resources available to kids. The financial landscape and technology around us has seen an exponential change in recent years, thereby making the need for financial literacy even more pressing, not just for children but for adults alike.

We aim to promote parent-child education where families can work on building their money habits and intellect together

Testimonials

Milestone Edutech Pte. Ltd.

Milestone Edutech Pte. Ltd.JustCo, Centrepoint Singapore,

176 Orchard road, #04-04,

Singapore. 238843

COPYRIGHT 2021-2022 I Privacy Policy I Terms and Conditions